Real-Word Use Cases of AI in the Insurance Industry

The rise of data-driven decision-making has allowed companies in the insurance industry to deliver more efficient, risk-adjusted solutions by using AI to analyze data. This means that companies can now offer each customer a more individualized experience while being in a better position to recognize the fraudulent activity. Since AI is offering insurance companies so many benefits, it should not come as a surprise that the AI adoption rate is so high. Let’s take a look at some interesting real-world use cases of insurance companies using AI in their everyday work.

Expediting the Data Extraction Process

When customers submit documents to the insurance companies, a lot of them are hand-written and a dedicated employee is necessary to input all of this information into the system. As you can imagine, this causes all kinds of delays since human workers can not work as quickly as machines. Liberty Mutual decided to incorporate AI into this process to remove the human element and expedite the process in general. They recently partnered with an analytics company to cut the time to extract submission data by 50% through the use of Artificial Intelligence.

Not only did this allow Liberty Mutual to expedite processing times, but it also allowed them to better utilize the data contained within the documents. A lot of the important data can either be inputted incorrectly or go unnoticed by human workers. Therefore, AI allows insurance companies, like Liberty Mutual, to get more value out of the underwriting documents and make faster, more informed decisions.

Such AI systems rely on optical character recognition technology to recognize the text written in the documents. This means that human data annotators would need to label various aspects of the text by drawing a bounding box around specific data. For example, the bounding box might be one color for recognizing names, but another for the date of birth. Since this is a very time-consuming process, a lot of companies choose to outsource such work to companies like Mindy Support.

Predictive Analytics

Progressive insurance is using machine learning to analyze around 14 billion miles of driving data they collected from their customers. They take the information collected from their mobile app and Snapshot, which is a plug-in device that tracks and records driving habits, and feed labeled data that connects accidents with the accordant driving data, the insurer could identify a pattern and predict a new customer’s likelihood of causing accidents by simply gathering hours of their driving data. It is important to note the importance of labeled data since this is what allows the AI system to understand all of the raw data and make the proper correlations between driving habits and accidents. Once again, this requires humans to annotate the data with various labeling techniques.

Another interesting usage of predictive analytics is being able to forecast the insurance needs of each individual client. Basically, the algorithms use various predictive signals contained in the data to look for specific events, or business life cycle activities to offer new and relevant insurance products that fit each customer’s needs. For example, let’s say that a startup has just secured large amounts of funding. Based on this information, the system will recommend Directors & Officers insurance. These are just some of the many benefits insurance companies can get from predictive analytics through AI.

Using AI to Detect Fraudulent Activity

According to the FBI, the total cost of insurance fraud (excluding health insurance) is more than $40 billion per year. Insurance fraud costs the average U.S. family between $400 and $700 per year. All of the fraud causes insurance rates to go up to help recoup some of the losses. Allstate Insurance is using AI to fight back against fraud. The AI system analyzes data from various claims and is able to spot suspicious ones that will require further human evaluation. One of the reasons AI is essential to fraud prevention is that top insurance companies, like Allstate, receive thousands of claims every day, making it impossible for a human worker to sort through all of them. AI allows insurance companies to automate the claim verification process, allowing them to reserve their employees for the claims that have been flagged by the system.

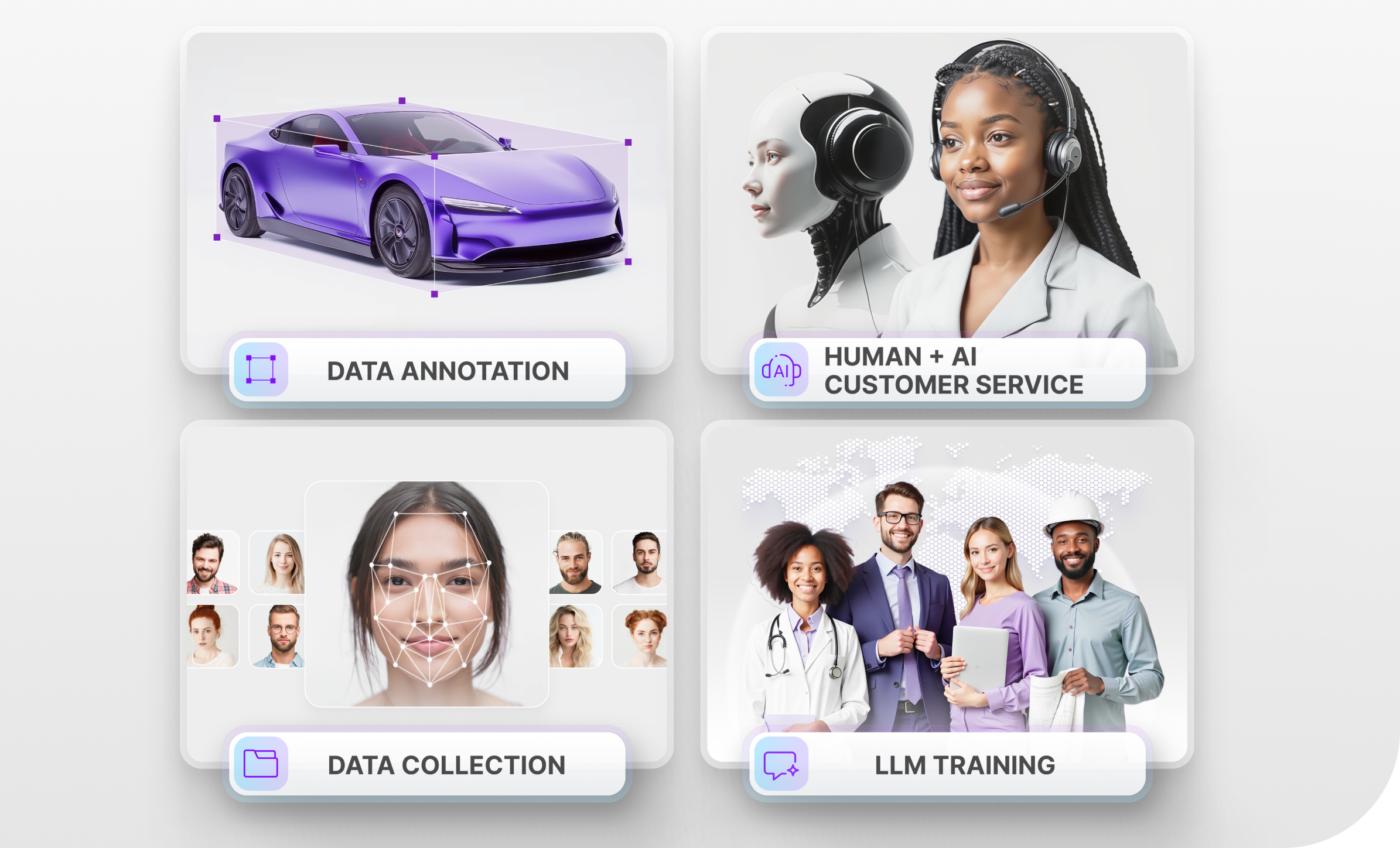

Trust Mindy Support With All of Your Data Annotation Needs

Regardless of the volume of data you need to be annotated or the complexity of your project, Mindy Support will be able to assemble a team for you to actualize your project and meet deadlines. We are the largest data annotation company in Eastern Europe with more than 2,000 employees in six locations all over Ukraine and in other geographies globally. Our size and location allow us to source and recruit the needed number of candidates within a short time frame and we can scale your team without sacrificing the quality of the work provided. Contact us today to learn more about how we can help you.