AI and Data Annotation Help Insurance Companies Fight Fraud

Identifying insurance fraud is not easy. Investigators need to sift through hundreds, maybe even thousands of documents about a particular case to determine if fraud has been committed. Potential fraud situations are only getting more complex, especially given just how much the world has become digitized. The vast majority (84%) of insurance organizations surveyed by the Coalition Against Insurance Fraud (CAIF) reported that fraud cases under investigation involved two or more industries. Closer to home, 26 billion scam calls were logged in 2019 (44% of all robocalls). Also, CAIF estimates that insurance fraudsters steal more than $80 billion a year from American consumers alone.

However, new advancements in AI could make fraud detection an exact science. Today we will take a closer look at the AI technology that could detect fraud and the data annotation necessary to create such a system.

How Can AI Help Fight Fraud?

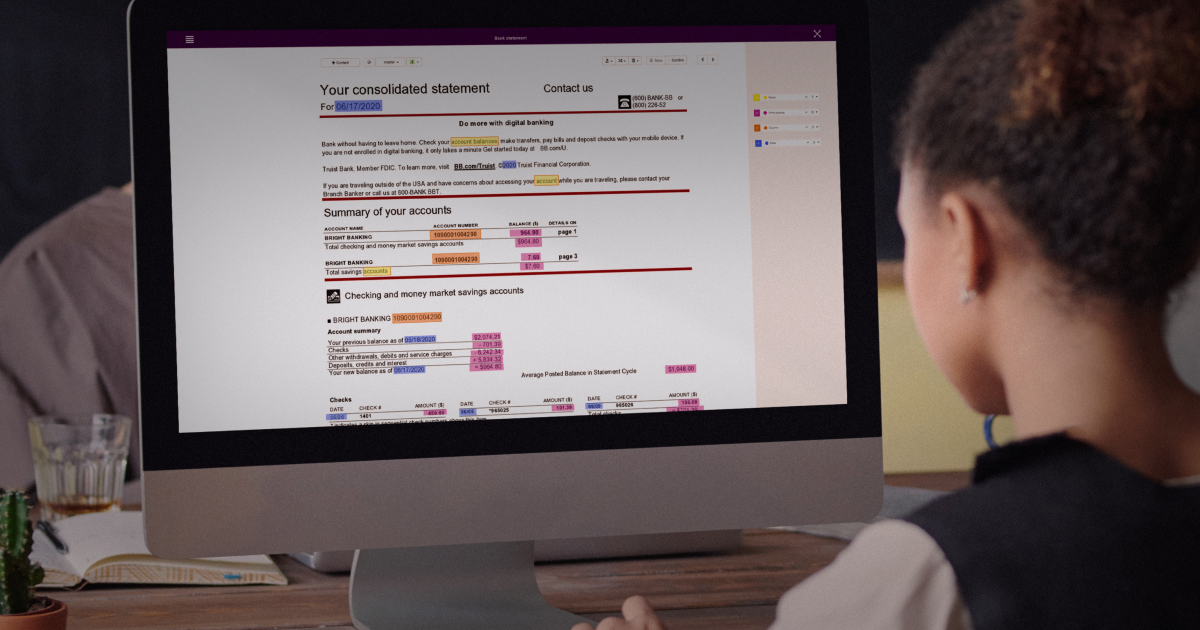

One of the biggest advantages offered by AI in the fight against fraud is the ability to analyze data and eliminate manual processes that take up a lot of time. For example, the eFraud Converter uses state-of-the-art AI technology to convert pdf images of bank statements into Excel without manual intervention. Once the conversion is complete, users review and correct suspected errors. This is a crucial step because investigators must attest to the accuracy of their reports when testifying in court.

Other tools allow insurance regulators to get out in front of potential fraud and prevent it from occurring. This is done by using AI to analyze behavior analytics and try to find patterns that could potentially indicate fraudulent activity is about to be committed. This insurance analytics software solution gives carriers a comprehensive ‘digital identity’ of their potential customers to help prevent fraud. Think of it as a digital polygraph that could measure user behavior and correlate it to fraudulent outcomes. By analyzing millions of behavioral patterns such as keystrokes, typing speed, hesitancy, and form corrections, ForMotiv is able to baseline normal (good) behavior and spot risky deviations from that behavior, much in the way a physical polygraph works.

What Types of Data Annotation are Required to Create Such AI Technology

If we take a product like the eFraud Converter, which requires optical character recognition capabilities, text classification would need to be performed by data annotators. They would need to tag key phrases and words to explain to the machine learning algorithm what to look for in a text and classify it. In addition to this, entity recognition would need to be performed, which involves locating, extracting, and tagging entities in text. They would also need to perform entity linking, which is connecting all of the tagged entities into larger repositories of data about them.

Since the system would need to discern between bank statements and other financial documents, text categorization would need to be done as well. Basically, the data annotators would need to read and analyze all of the documents used for training data and categorize them into categories such as bank statements, financial receipts, tax documents, and other categories. Using text classifiers, companies can automatically structure all manner of relevant text from the needed documents, which allows them to save time analyzing text data, automate business processes, and make data-driven business decisions.

Improve Your Fraud Detection Rates With AI

Certainly, insurance companies would like to raise their fraud detection rates since it’s costing them money and increasing premiums for other customers. When we delve down deeper into the problem, we see that there is a narrow focus, a lack of consistency, and an increase in preventable loss. The absence of quality industry data prevents insurers from benchmarking their own counter-fraud performance. Consequently, manual detection statistics and fraud-level perceptions remain on opposite sides of a very high fence.

What low detection rates reveal is multiple weaknesses in the current models used to combat fraud. Part of the problem is the lack of understanding in the C-suite of just how much their respective company is exposed to potential fraud and how effectively they can combat the fraud once it’s detected.

Trust Mindy Support With All of Your Data Labeling Needs

Mindy Support is a global company for data annotation and business process outsourcing, trusted by several Fortune 500 and GAFAM companies, as well as innovative startups. With 9 years of experience under our belt and offices and representatives in Cyprus, Poland, Romania, The Netherlands, India, and Ukraine, Mindy Support’s team now stands strong with 2000+ professionals helping companies with their most advanced data annotation challenges.